pet medical insurance for cats: clear questions, careful choices

What it covers - and what it doesn't

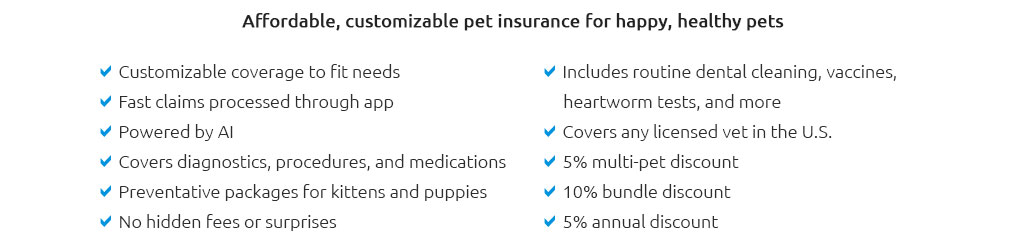

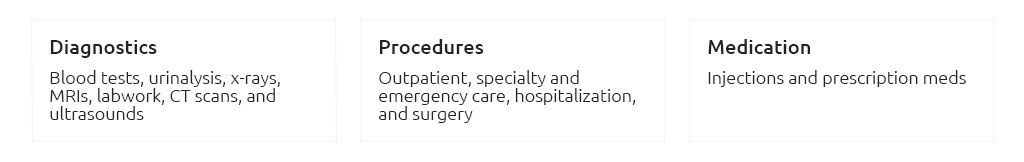

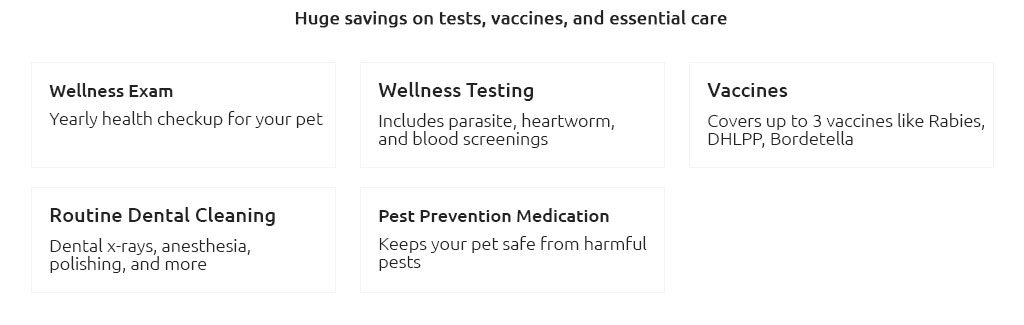

Insurance for cats generally reimburses you for unexpected accidents and illnesses. Think diagnostics, imaging, surgery, hospitalization, meds. Wellness add-ons (vaccines, flea prevention, dental cleanings) are separate and optional. Policies reimburse after you pay the vet, so cash flow matters.

How it works, in practice

- You choose a deductible (per year, typically) and a reimbursement level (e.g., 70% - 90%).

- The plan sets an annual coverage limit (some offer unlimited).

- Waiting periods apply after enrollment; accidents and illnesses may have different clocks.

- You visit any licensed vet, pay the bill, submit a claim, and receive reimbursement if it's covered.

Core terms decoded

- Pre-existing conditions: Signs or symptoms before enrollment or during waiting periods are usually excluded.

- Bilateral conditions: If one knee is diagnosed pre-enrollment, the other knee may be excluded - read that clause.

- Chronic conditions: Covered if first occurred after waiting periods and plan stays active; lapses can reset coverage.

- Exam fees: Not all policies reimburse the vet exam fee itself.

- Dental: Injury is commonly covered; dental disease is often excluded unless specifically included.

Realistic check: You'll still need accessible funds to float the vet invoice before reimbursement, especially for emergencies.

Costs and what drives them

Premiums for cats are often lower than for dogs; a broad range might be roughly $15 - $40 per month for a young, mixed-breed indoor cat, climbing with age, location, and richer coverage. Older cats, higher reimbursement levels, and lower deductibles cost more.

Coverage details worth a microscope

- Waiting periods: Are there separate accident/illness periods? Any orthopedic exclusions?

- Hereditary conditions: Hypertrophic cardiomyopathy, patellar luxation - confirm inclusion.

- Prescription meds: Covered? Any per-prescription caps?

- Rehab/alternative care: PT, acupuncture, laser therapy - explicitly listed or not?

- Behavioral care: Sometimes covered when tied to a diagnosis; sometimes excluded.

- Dental illness: Disease vs injury language matters.

- Annual limits: One big emergency can use up a low limit.

- Price creep: Premiums generally rise as cats age; look for transparency in rate changes.

- Geographic travel: Coverage when visiting another state or country?

A real-world moment: the claim

My cat batted a piece of string off the counter and swallowed it. ER visit, radiographs, overnight observation. In the parking lot, I snapped a photo of the itemized invoice and submitted the claim in the app. A week later, reimbursement landed via direct deposit. Not glamorous - but it worked when I needed it.

Who benefits most

- Kittens and young adults: Lower premiums; coverage in place before issues emerge.

- Cats with outdoor access: Higher accident risk.

- Guardians without a large emergency fund: Insurance smooths volatility.

- Multi-pet homes: One policy per pet, but the predictability helps budgeting.

If you skip insurance

- Self-insure: Auto-transfer a fixed amount monthly into a dedicated savings bucket.

- Emergency-only coverage: Cheap accident-only policy plus savings for routine care.

- Payment options: Some clinics offer plans; read interest and fees carefully.

- Community resources: Low-cost clinics and charities exist, but availability varies.

Comparing plans like a researcher

- Decide your risk tolerance: higher deductible lowers premiums.

- List must-have benefits (e.g., exam fees, meds, dental illness).

- Read sample policies - not just brochures - for exclusions and definitions.

- Check claim turnaround averages and channels (app, portal, email).

- Review age-based premium projections and how rate hikes are communicated.

Small signals of a solid policy

- Plain-language summary mapped to the full contract.

- Itemized EOBs that show allowed amounts and reasons.

- No gotchas on chronic or bilateral conditions established after enrollment.

- Clear appeals process.

Common pitfalls to avoid

- Glossing over waiting periods: Illness in this window will likely be excluded.

- Letting the policy lapse: Can jeopardize coverage of ongoing conditions.

- Misreporting history: Inaccuracies can sink a claim review.

- Overlooking sub-limits: Some policies cap specific treatments (e.g., rehab).

- Assuming wellness is standard: It's usually an add-on and may not be cost-effective.

Quick math, illustrative only

Say an ER bill is $1,500. With a $250 annual deductible and 80% reimbursement, the covered portion is $1,250; reimbursement is $1,000. You pay $500 out of pocket for the incident. If your annual premium is $480, your total yearly cost becomes about $980 versus $1,500 without insurance. If you make no claims that year, you spent $480 for peace of mind. Your numbers will vary.

Health realities that shape value

- Urinary issues: Male cats can obstruct; costs escalate fast with hospitalization.

- Dental disease: Prevalent with age; most plans require explicit dental illness coverage.

- Chronic kidney disease: Common in seniors; ongoing labs and meds add up if covered.

Checklist before buying

- Annual vs per-incident deductible - what's the structure?

- Reimbursement on invoice or on a benefit schedule?

- Exam fees covered?

- Prescription meds and chronic conditions included?

- Any breed-specific or bilateral exclusions?

- Clear, written policy with sample contract available?

Bottom line

Awareness first, purchase second. Read the fine print, match coverage to your cat's risks and your budget, and plan for the upfront payment at the vet. If the math and the terms make sense, pet medical insurance for cats can turn a scary invoice into a manageable bill - and that changes decisions in the moments that matter.